can you look up a tax exempt certificate

The sales tax license and exemption certificate are commonly thought of as the same thing but they are actually two separate documents. Sellers are required to charge sales tax on all transactions subject to tax except when a jurisdictions rules allow for the sale to be made tax-exempt.

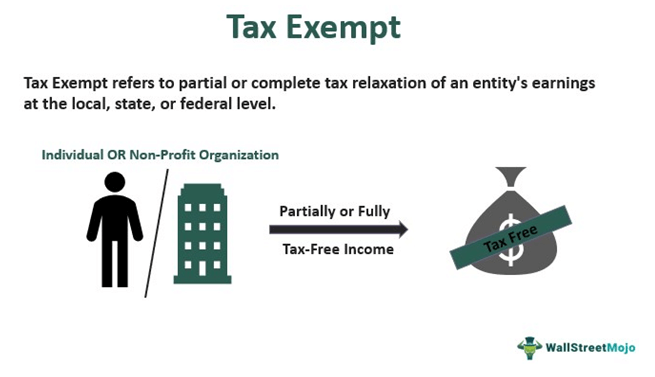

Tax Exempt Meaning Examples Organizations How It Works

Alabama Login required.

. Sales and use tax. It is important to read the regulations to determine whether the sample exemption certificates apply to your transactions. For questions or assistance please contact DOR Customer Service Bureau at 608 266-2776 or.

Sellers should exclude from taxable sales price the transactions for which they have accepted an exemption certificate from a purchaser as described below. Although you cannot search by tax exempt number you can search by the organization and location. Information on how to verify sales and.

Enter the name of the organization in the first box and the 13-digit certificate number in the second box. Fully complete the information in tabs 1 through 4 before providing your vendor with an electronic copy of the certificate or a printed and signed copy. Most states have a variety of different expiration dates for STECs depending on the type of certificate and the business taxable status.

Exemption Certificate Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify. Please see the Suggested Format for an Exemption Certificate Based on Propertys Use Form DR-97. Paul MN 55146 Phone.

To find the identification number of a Colorado charitable organization use the Charity Lookup Tool or visit the Colorado Secretary of States Office website. Vendors are often confronted with customers who wish to make purchases tax free either because they intend to resell the item or because the customers are making a purchase for a non-profit organization an individual or a business possessing a valid Tennessee certificate of exemption. Revenue Minnesota Department of.

Use the form below to verify that the customer possesses a valid tax exempt number or. Sales tax exemption certificates STECs allow businesses to purchase items exempt from sales tax. Exemption certificate instructions can be found here.

Businesses are often confronted with customers who wish to make purchases tax free either because they intend to resell the item and charge the sales tax or because they are making a purchase for an organization possessing a tax exempt card issued by the State Comptrollers Office. The certificate must be presented to the vendor at the time of purchase in order to receive the exemption. Statewide group organizations might have one listing with All Branches as the city rather than a separate listing for each local chapter.

ST-11A for more information about Form ST-11A please call 804367-8037 Semiconductor Manufacturing. Exemption certificates are signed by purchasers and are given to sellers to verify that a transaction is exempt. An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase.

Sales and Use Tax Certificate Verification Application. How to Verify a Resale Certificate in Every State. You can verify that the organization is a tax exempt non-profit organization.

Click Verify The next page will verify if the organization holds a Sales Tax Annual Resale Certificate Consumers. You can print a copy of your Certificate of Registration or License using MyTax Illinois. You may also contact the Internal Revenue Service at 877829-5500 and ask that they verify the.

View or make changes to your tax exemption anytime. Arkansas Use either the resellers permit ID number or Streamlined Sales Tax number. Sales and Use Tax Exemption Verification Application.

From there click the Start Over button Business Verify an Exemption Certificate. Exemptions are based on the customer making the purchase and always require. Brought to you by Techwalla.

If you choose to list Amazon or any of its subsidiaries as a seller of record on the certificate we can only exempt you from those purchases. Sellers must retain copies of the exemption certificates. Choose Search and you will be brought to a list of organizations.

Arizona Enter the number here. Use the drop-down menu to select Sales Tax as the reason for the verification request. Sales Tax Exemption Certificates for Governmental Entities.

From your MyTax Account the Certificate of Registration or License is located by selecting View more account options and then View Account Letters in the Letters and Messages panel. This page includes links to the sample exemption certificates that are included in regulations and to the regulations themselves. Number should have 8 digits.

Vendors are often confronted with customers who wish to make purchases tax free either because they intend to resell the item or because they are making a purchase for a non-profit organization an individual or a business possessing a valid Tennessee certificate of exemption. To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers. Form ST16 Application for Nonprofit Exempt Status-Sales Tax.

Organizations that are exempt from federal income tax under 501c3 will generally be approved for a sales tax certificate of exemption in Colorado. If the item is tax exempt under a specific exemption based on its usage and is not for resale the purchaser should give the seller an exemption certificate. Sign in with the business account you will be making tax exempt purchases with.

Florida law grants governmental entities including states counties municipalities and political subdivisions eg school districts or municipal libraries an exemption from Florida sales and use tax. Cleanrooms equipment fuel power energy and supplies used in the manufacture or processing of semiconductors are not subject to sales tax. To get started well just need your Home Depot tax exempt ID number.

The sales tax license allows a business to sell and collect sales tax from taxable products and services in the state while the exemption certificate allows the retailer to make tax-exempt purchases for. You can also contact our Central Registration Division at 217 785-3707 or by. Let us know and well give you a tax exempt ID to use in our stores and online.

Do not send this form to the Department of Revenue DOR. The Minnesota Department of. Many regulations include examples of exemption certificates that a purchaser might issue to a seller.

Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from Sales and Use Tax Franchise Tax and Hotel Occupancy Tax.

Tax Exempt Meaning Examples Organizations How It Works

Sales And Use Tax Exemption Letter How To Write A Sales And Use Tax Exemption Download This Sales Letter With Use Of Ta Tax Exemption Lettering Sales Letter

Tax Reporting Compliance Faqs Finance Business

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

How To Fill Out Irs Form W 4 Exempt Youtube

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

Sales Tax Campus Controller S Office University Of Colorado Boulder

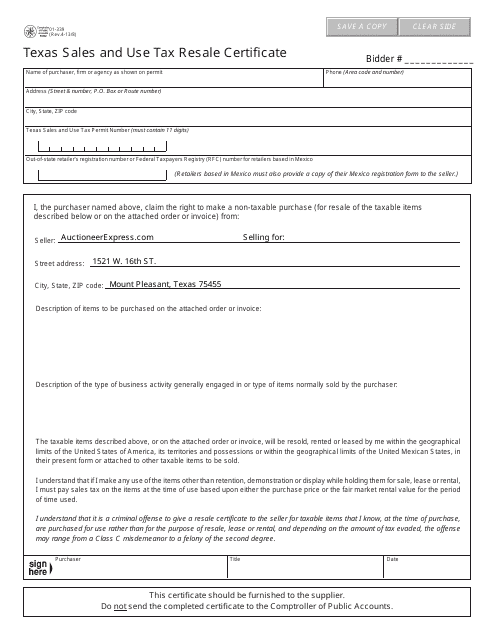

Form 01 339 Download Fillable Pdf Or Fill Online Texas Sales And Use Tax Resale Certificate Texas Templateroller

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

Form St 119 1 Download Fillable Pdf Or Fill Online New York State And Local Sales And Use Tax Exempt Organization Exempt Purchase Certificate New York Templateroller

Florida Tax Exemption Forms Aviall Support Center For Best Resale Certificate Request Letter Template Letter Templates Lettering Free Gift Certificate Template

Sales Tax Campus Controller S Office University Of Colorado Boulder

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Sales And Use Tax Exemption Certificate Form 149 Tax Exemption Filing Taxes Tax

/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)

Form 990 Return Of Organization Exempt From Income Tax Definition

Tax Exempt Meaning Examples Organizations How It Works

Application For Hospital Sales Tax Exemption Tax Exemption Illinois Sales Tax